- HOW TO CALCULATE EQUAL WEIGHTED STANDARD DEVIATION HOW TO

- HOW TO CALCULATE EQUAL WEIGHTED STANDARD DEVIATION FREE

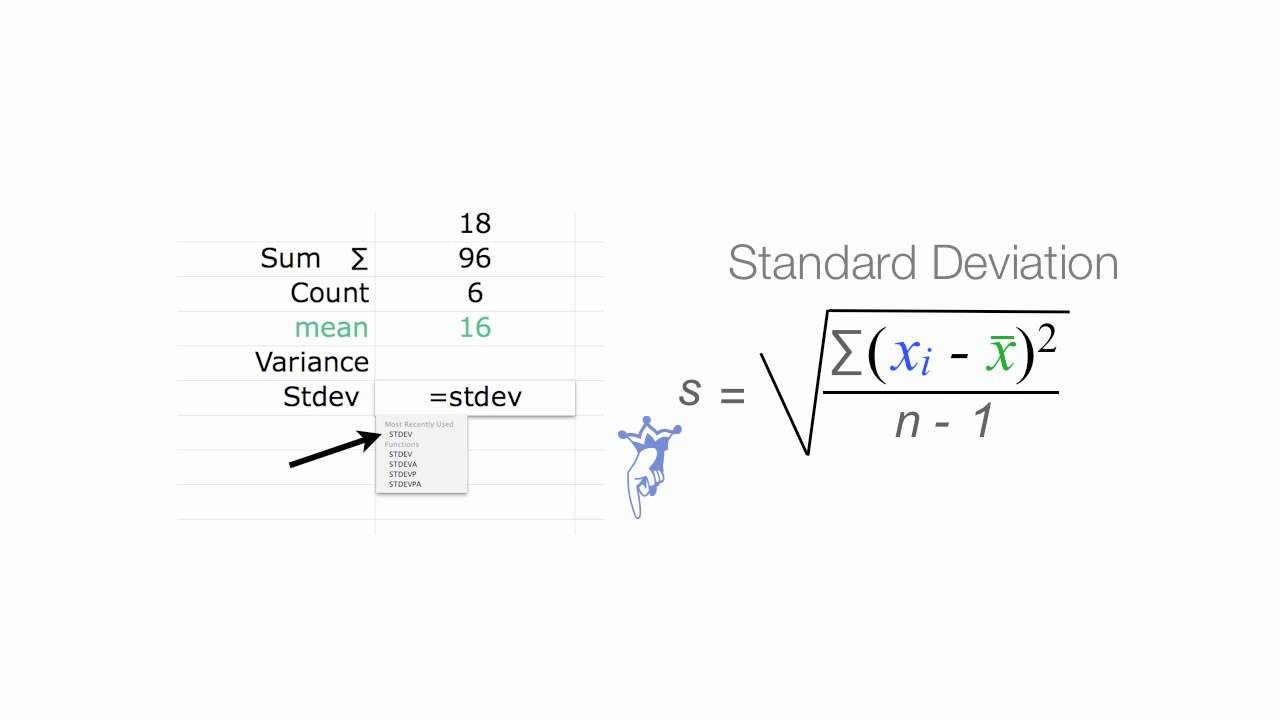

Portfolio Standard Deviation is the standard deviation of the rate of return on an investment portfolio and is used to measure the inherent volatility of an investment. It measures the investment’s risk and helps in analyzing the stability of returns of a portfolio. Let’s understand the portfolio standard deviation calculation of a three asset portfolio with the help of an example: Apply the values in the above-mentioned to derive the Standard Deviation formula Standard Deviation Formula Standard deviation (SD) is a popular statistical tool represented by the Greek letter 'σ' to measure the variation or dispersion of a set of data values relative to its mean (average), thus interpreting the data's reliability.

Correlation can vary in the range of -1 to 1.

HOW TO CALCULATE EQUAL WEIGHTED STANDARD DEVIATION HOW TO

How to Calculate Portfolio Standard Deviation? Standard Deviation of Portfolio is important as it helps in analyzing the contribution of an individual asset to the Portfolio Standard Deviation and is impacted by the correlation with other assets in the portfolio and its proportion of weight in the portfolio.

ParticularsĪverage Rate of Return for the Last 3 Years read more, if Raman wishes to avoid excess volatility, he will prefer investment in Fund A compared to Fund B as it offers the same average return with less amount of volatility and more stability of returns. Thus based on his risk appetite Risk Appetite Risk appetite refers to the amount, rate, or percentage of risk that an individual or organization (as determined by the Board of Directors or management) is willing to accept in exchange for its plan, objectives, and innovation.

:max_bytes(150000):strip_icc()/dotdash_Final_Exploring_the_Exponentially_Weighted_Moving_Average_Nov_2020-04-b65a26eed33f451ba51fabe7298561a7.jpg)

Source: Portfolio Standard Deviation () Example

HOW TO CALCULATE EQUAL WEIGHTED STANDARD DEVIATION FREE

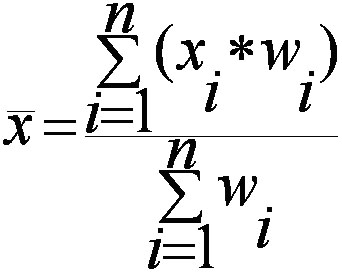

You are free to use this image on your website, templates etc, Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked A Portfolio with low Standard Deviation implies less volatility and more stability in the returns of a portfolio and is a very useful financial metric when comparing different portfolios.A high portfolio standard deviation highlights that the portfolio risk is high, and return is more volatile in nature and, as such unstable as well.Portfolio Standard Deviation is calculated based on the standard deviation of returns of each asset in the portfolio, the proportion of each asset in the overall portfolio i.e., their respective weights in the total portfolio, and also the correlation between each pair of assets in the portfolio.This helps in determining the risk of an investment vis a vis the expected return. Interpretation of Standard Deviation of Portfolio Portfolio Standard Deviation refers to the volatility of the portfolio which is calculated based on three important factors that include the standard deviation of each of the assets present in the total Portfolio, the respective weight of that individual asset in total portfolio and correlation between each pair of assets of the portfolio.

0 kommentar(er)

0 kommentar(er)